Property development is one of the most exciting ways of becoming your own boss. Property development is all about buying at the right price, adding value and selling for a profit but all that is easier said than done. However you first need money to make money. Financing your first crack at property development is the hardest as it’s unlikely you have ready access to a large amount of money. In this post I’ll look at how to secure the initial finance to begin developing property.

Calculate the cost

Apart from the sale price of an existing property or the land to build on you’ll also need money for professional and legal fees associated with the purchase and securing finance, the building work, the mortgage repayments, utilities, labour costs and insurance. Depending how you get the money for the development you may need up to 40% of the total cost at your disposal already. Check out all your options below:

Mortgage companies

A mortgage is one of the most common ways to finance a first foray into property development. A mortgage differs from other loans by using property, either an existing property or the one you plan to build, as security aka collateral for the money lent. If you fail to repay the loan then the property passes to the lender.

- A standard mortgage generally requires a large percentage of the total cost upfront i.e. you’ll still have to find around 40% of the money yourself. A good rule of thumb when calculating how much you’ll be able to borrow is to multiple your annual salary by 3.5. Ask yourself if this is enough to cover all your costs? The more secure your own situation i.e. your salary, job security and value of current property, the more likely you are to get a good rate on a mortgage. Lenders like to see evidence that lending to you will be profitable to them which includes your ability to pay back loans. Money Saving Expert has a good guide to understanding credit rating and how you can improve yours.

- Another type of mortgage, which is less demanding, is a buy-to-let mortgage. When you apply for a buy-to-let loan you must show that your property will generate 125% of your mortgage repayments through rent once the development is complete.

- The last mortgage type useful for raising cash is a re-mortgage. You can re-mortgage your home in order to free up the ‘equity’ held in your current property. Equity is the difference between the value of your home and the amount it’s already mortgaged for. You can then use this money to finance your development.

When seeking a mortgage it’s imperative to use a mortgage broker. There are two kinds of broker; an independent broker who isn’t affiliated with any mortgage firms and a ‘commission-tied’ broker who will only sell you a package that they will benefit from. Charted accountants can act as independent brokers, providing property investment accounting to help you secure finance at the best rates.

Alternative finance

- Friends and family can help you either by providing the start up cash or by acting as a guarantor on a loan. You need to be sure that this person is aware of the risks associated with property development. If something goes wrong they will be worse off than you will be if they’re financially tied to the development.

- Funding for special interest builds may be available either from your local authority or from a private investor. What deems your build to be of special interest? It should involve innovative materials or methods that may benefit the wider community by making a case for cheaper or more environmentally friendly building practices. Eco homes including strictly standardised ‘passive houses’ are very popular with home owners and investors who view them as the future of housing.

- High street banks often have fantastic deals on loans or mortgages. As I’ve discussed mortgages already I’ll look here at bank loans that don’t involve mortgaging property. You may get preferential rates if you bank with them already. A loan specifically given for property development is usually quite short term with repayment expected in just a year or two. They can be more difficult to secure for first developers because a good track record of successful previous developments may be necessary.

- Embarking on a joint venture will mean you share the costs and the responsibility for the project. The ratio of investment and hands on involvement should be agreed by both parties before any arrangement is entered into. Joint ventures always run the risk of your partner letting you down in some way e.g. not pulling their weight or procrastinating on joint decisions.

Risks of property development

As I said earlier, while property development is exciting it’s also risky (perhaps one of its appeals for many people). The property market is a volatile sector, made even more so by the rocky economic climate in general. When securing finance from a bank or mortgage company the state of the market and future predictions for the rise or fall in house prices will affect the rate of lending you receive. Your lender will conduct their own research into the current risks and provide better rates when less risk and greater profits are likely.

Property builds or renovations inevitably incur delays for one reason or another which can be filled with risk if your budget lacks elasticity. A tight budget is important but you must have some flexibility for cash sucks like delays. If you don’t have any stretch in the budget you may end up having to give up the project altogether, accepting a loss in profits to avoid total bankruptcy.

That said the risk can often pay off. Take time to consider the current property market, find the right development and consider how you can add value. If the conditions are right take the leap!

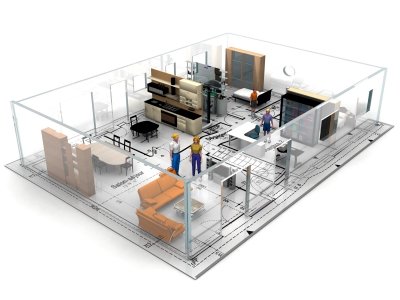

Image courtesy of njaj /FreeDigitalPhotos.net