Facebook started off as a social media platform, so that people could interact with each other. Now, who needs interaction desperately? Let’s substitute interaction with engagement. Now does it ring a bell? Marketers, maybe?

Brands looking to create a top of the mind recall in the heads of the customers, businesses looking to grow, to acquire new customers and create an ever-lasting relationship with the existing ones. Facebook, with its vast user base, a number of engagement options and ease of connection, provides an ideal platform for all this and much more. It provides a base for the simplest, and yet the most powerful form of promotion, word-of-mouth.

What’s more? Having realized the opportunity, Facebook came up with Facebook for business, a dedicated service for brands to advertise and actually grow, with metrics to define this growth. Metrics, which are much more relevant in today’s world than the conventional ones. What many of us don’t realize today is the impact of our social lives on the decisions we take personally, and this impact is precisely what has led to Facebook marketing becoming a vital cog in the marketing mix of any successful brand.

With Facebook for business, the platform transgressed to a whole new level. It provides highly customizable promotion routes which can be used by both small and big businesses alike, custom made to suit the purpose of their advertising/promotion. In this issue we explore the world of Facebook marketing, and what it can offer to these businesses.

Dynamic Adverts:

Dynamic content is highly relevant in the ever changing scenario today. Facebook offers dynamic adverts for businesses that have large product catalogs. This has many benefits:

- Increases success ratio: By customizing what products to show from amongst the catalog to which user based upon his likes, the promotions are much more effective

- Scalability: The campaigns and adverts can be scaled up and down as per your requirement

- A cross-device experience: The adverts are independent of the original touch point, providing a seamless experience to the user

In the end, it is all about targeted marketing, and with all sorts of data about user preferences and likes, Facebook offers a very powerful and methodical way to do so.

Facebook allows you to manage your own promotional campaigns and customize it as per your requirements via its Advert Manager Tool, and an app for the same. Let us learn about their features.

Targeting Options:

You can choose the target audience to which you want your advert to be conveyed on the basis of:

- Location: country, region, postal code

- Demographics: age, gender, language

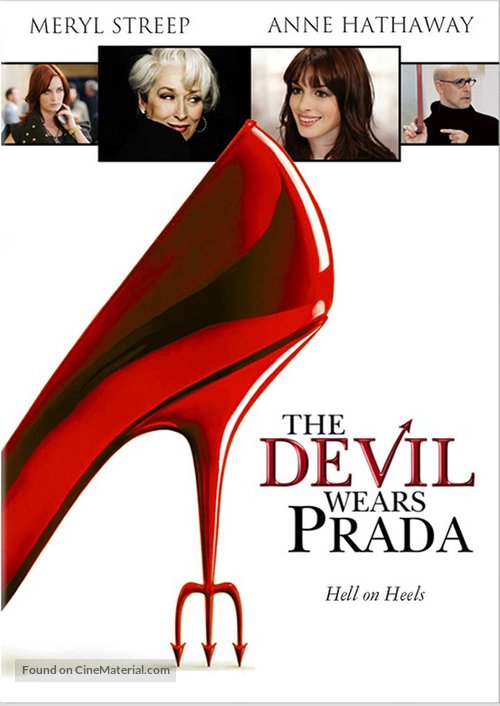

- Interests: movies, sports, music, reading, shopping

- Behavior: the kinds of products/content which users view and finally engage with

- Connections: people who like pages, apps, etc. through their connected friends

Features:

- Custom Audiences: This allows you to connect to your existing customers on Facebook, on the basis of your contact list, your website traffic or app activity; ideal for engagement

- Lookalike Audiences: An excellent way to attract new users, this feature uses insights from Facebook marketing to provide an audience similar to your best customers

Such kind of targeting is thus, both highly relevant and actionable, with various possible calls to action like – directions to your store, downloading your app, redirecting to your website or maybe even place an order directly. At the same time, it allows you to target social acquaintances of users who engage with your adverts, thus a more effective means to channel your communication.

Success and Result Measurement Tools:

One of the greatest positives in Facebook marketing is the provision of highly relevant metrics to gauge the impact of your adverts and campaigns.

Facebook terms these as Page Insights. These include:

- Likes: It tells you how many people liked/un-liked your content; and the channel through which they did so.

- Reach: It is a measure of total engagement with your content and includes likes, comments, and shares. It consists of both your organic reach and engagements via Facebook adverts.

- Visits: Implies the user base which responds most to your adverts, their characteristics, and channel of engagement.

- Posts: This monitors responses to your posts which include clicks and likes. It also gives an in-built option to boost your posts.

- Visitors: Perhaps the most essential one, this allows to see the demographics of your user base and their times of engagement, allowing you to put up the right content at the right time for maximum visibility and effect.

Adverts Performance:

1. Track your daily expenditure on promotions and campaigns.

2. Run multiple campaigns for your business and monitor them all at one place.

3. Monitor your average cost per action, an excellent metric for gauging return on investment in campaigns for post engagement.

4. Each campaign can be individually monitored, with Facebook doing all the number crunching.

5. Gauge whether your adverts are really adding value or not.

Facebook Pixel:

This unique feature combines the best features of conversion tracking and custom audience, into a piece of code which Facebook advertisers and marketers can insert into the coding of their respective websites to measure and optimize their marketing attempts. It even allows Facebook to build suitable audiences for their advert campaigns.

Its beauty lies in the fact that it allows you to integrate your Facebook marketing efforts with your website, hence allowing you to streamline your adverts and their positioning according to the current dynamics of users that engage with your website. The functionality includes:

- Cross-device conversions: Based upon the need for conversion optimization, this allows the marketer to trace the entire conversion process and at the same time provide a seamless experience to the user. It even measures the cost per conversion through your adverts.

- Custom Audiences: This augments the custom audiences feature in that it finds your website visitors on Facebook and then includes them in your custom audience list increasing the probability of engagement and brand recall.

- Traffic Analysis: It provides an analysis of your website traffic, providing you pointers to the section of population that is most likely to engage, and that you should target in future.

- Projects your advert to relevant users only, engages with your website visitors after finding them on Facebook.

After all, creativity is the strongest competitive advantage any business can possess. Facebook offers you a medium to show your most creative side and at the same time ensure that it reaches the correct section of users, the one you intend to engage with. The best of both worlds, if I may say so. This kind of mass customization is exactly what businesses are looking out for today.

Thus, Facebook marketing is indeed a highly relevant component of digit marketing and will only grow in importance, and in terms of the value, it adds to businesses, as the modern man becomes more and more social. Hence this form of marketing cannot and should not be overlooked, as it promises an optimized approach.